This has been the goal for a long time – corporate global governance, enforced by advanced monitoritoring technology and social credit scores. We are seeing the final stages of the maturation of the techno-fascist surveillance state, which began in earnest 19 years before the Covid 19 epidemic: on 9/11/2001. Then, in 2010, Richard Florida, an influential social engineer from the University of Toronto’s Martin Prosperity Institute, coined the term ‘Great Reset’ in order to describe a seismic transformation of the global economy based on concentrating most of the world’s inhabitants into urban megacities.

Here is an excerpt from a review of his book:

“In The Great Reset, Florida examines the roots of our current economic crisis. Unlike most observers, Florida argues the crisis is not merely a temporary emergency in government policy. It is a fundamental shift in our economic system—a “great reset.” Florida claims that times of major economic crisis necessitate the resets. Every reset involves a spatial fix, a change in where we live and work. The first reset involved a movement from farms to cities. The second involved suburbanization. Our current reset is a move towards mega regions, dominated by major urban centers.”

See: https://c2cjournal.ca/2010/06/the-great-recession-or-the-great-american-opportunity/

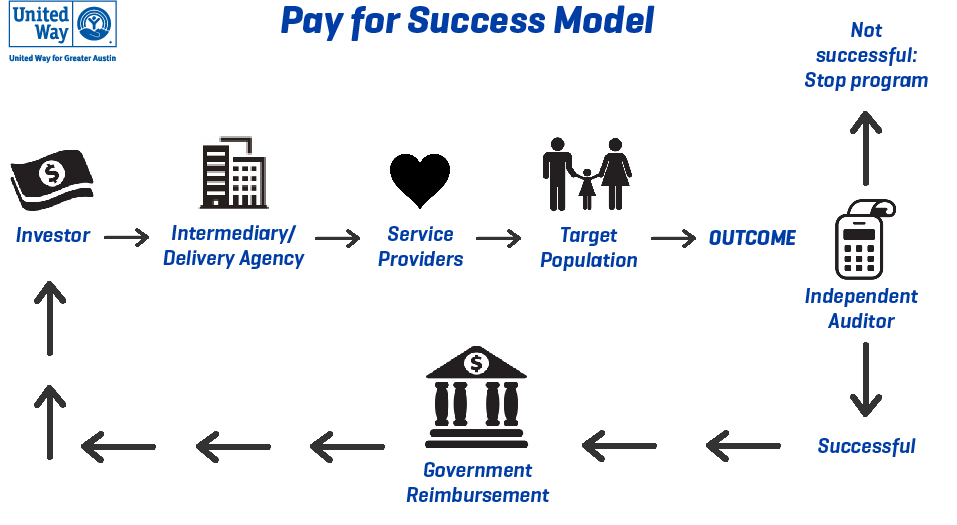

2010 was also the year that Sir Ronald Cohen, an investor from the UK, developed the first Social Impact Bond (SIB), a financial instrument that incentivizes corporate investments in social impacts/outcomes in roughly the same way as a bonus for early completion of a contract would incentivize a private company to agree to accept a public project. SIBs are also called Development Impact Bonds (DIBs) or Pay for Success Contracts (PFS) and all fall under the category of Social Impact Finance (SIF). The language of “what works,” “data-driven,” “performance-based,” “results-oriented,” etc. signals a shift toward private social impact financing rather than, or in conjunction with, public tax revenues.

MaRS, a Toronto-based “engine to lead Canada in the Innovation Economy,” explains Cohen’s social impact revolution in a 2010 article, excerpted here:

“Sir Ronald’s goal is to connect the capital markets to the social sector. “It is not enough to increase the standard of living at the high end. It is right at the same time to worry about those who are left behind,” he says.

It would be a shame to waste the economic crisis that we have just endured and not learn lessons from it. Sir Ronald offers the following reflection and I would suggest hope that “societies everywhere will come to the conclusion that an important part of the capitalist system is having a powerful social sector to address social issues, because government doesn’t have the resources.”

Sir Ronald and his colleagues have formed an organization appropriately called “social finance” and have come up with the concept of a Social Impact Bond – “a contract between a public sector body and Social Impact Bond investors,” in which the former commits to pay for an improved social outcome. Investor funds are used to pay for a range of interventions to improve the social outcome.

“By enabling non-government investment to be utilized, Social Impact Bonds will lead to greater spending on preventative services. These interventions can have a direct impact on costly health and social problems.”

“Social Impact Bonds are a unique funding mechanism, in that they align the interests of key stakeholders around social outcomes”.

See: https://www.marsdd.com/news/sir-ronald-cohen-on-social-finance-the-next-big-thing/

In 2016, Cohen explained that SIF would be a crucial mechanism to compensate for pervasive budget deficits that had rendered many governments across the world incapable of providing basic services for the people they serve. Austerity is a precondition for shifting from public finance to private SIF:

“Governments across the world are throwing up their hands when they see the “yawning gap” between the need for social services and their ability to pay for them, Cohen said. “We’re beginning to see governments across the world saying, ‘We can’t cope. We need money from the capital markets.’” Venture capital, he said, was a response to the needs of tech entrepreneurs: “Why can’t we find a similar response to the needs of social entrepreneurs who are motivated by empathy to help others?””

See: https://www.gsb.stanford.edu/insights/how-connect-social-entrepreneurs-capital

Then, in April of 2020, when many people were still trying “flatten the curve” of the forecasted surge in cases of the novel coronavirus, and before the public announcement of the Abraham Accords, an article in Arabian News discussed the promise of SIF for addressing the social and economic weaknesses exposed by the Covid 19 epidemic:

“The World Health Organization (WHO) declared Covid-19 a pandemic on March 11th, 2020 causing significant economic and social implications, which continues to evolve rapidly across the world.

The persistent effort for finding long-term solutions to overcome its effect is both ongoing and at the forefront of governments, corporates, philanthropic foundations and the global community itself. There is a need more so than ever to look for innovative ways to combat the situation and relieve its effects. One such solution gaining traction in the market is the use of social impact bonds (SIB). As Sir Ronald Cohen stated “A SIB is an excellent tool for preventing different harmful matters and global issues”.”

The social impact bond blends public-private partnerships (PPPs), results-based financing and impact investing. Within a social impact bond, private investors provide up-front capital for social needs and are repaid by a measurable outcome funder dependent on the achievement of agreed-upon results which is similar model to a “green bond”. The COVID-19 crisis has presented significant challenges for the global economy, and society which has paved the way for the adoption and exploration of social impact bonds.”

See: https://www.arabianbusiness.com/comment/445960-lasting-bond-are-social-impact-bonds-the-solution-to-respond-to-covid-19

Cohen’s interview in 2016 explains how measurement toward actionable goals is key to making SIF work for investors and the public. The aspirations of the UN Sustainable Development Goals conveniently provide the substance of global set of targets for environmental, social, and governance (ESG) investments that ought to benefit all “stakeholders.” Responsibility to those stakeholders requires “evidence-” or “science-based” policies that can demonstrate “transparency” and rule out “bias” in policy-making and ensure that no one is “left-behind.” The criterion of “science” is using raw data, measurement -as much of it as possible and in real-time- in the construction of any given policy. Continuous measurement tracks a program’s progress toward SIF outcomes, or success metrics, the achievement of which triggers a success payment – hence the phrase Pay for Success.

Like the fallout of 9/11, the response to Covid 19 has – under the auspices of “safety” – amped up the surveillance infrastructure that is needed for the transition to the Impact or Innovation Economy. Wearable technology, contactless digital currency, remote work (which brings corporate surveillance into private homes), and economic devastation that will force many businesses and homeowners to default on mortgages, leaving those properties ripe for social impact investors like BlackStone and BlackRock to restructure patterns of real estate and land use: toward the Great Reset described by Florida in 2010.

Make no mistake, C19 is not about a public health crisis at all. It is a controlled demolition of the global economy that paves the way for corporate investors and venture capitalists to “Build Back Better” by launching the social impact (engineering) economy.”