“The elimination of cash will be a consequence of digital payment systems – whether public or private – proliferating. The reality is that, in a cashless world, every transaction will leave a digital trace, such that the transaction is either [viewable] by a private payments provider or by the central bank or some government agency.”

Economist Eswar Prasad in an interview with Coindesk

https://www.coindesk.com/policy/2021/09/20/central-banks-vs-private-currencies-the-future-of-money-with-economist-eswar-prasad/amp/

The Dialectic: CBDC vs. Bitcoin

Since the U.S. Federal Reserve launched its FedNow payment system in July 2023, public concern over the dangers of Central Bank Digital Currencies – CBDCs – seems to be (modestly) on the rise, or at least acknowledged by a growing number of mainstream press and publications. Although the FedNow system does not itself establish the mechanism for launching a CBDC, some commentators say that it is a crucial step in that direction. It’s a slippery slope toward a brave new world in which trackable, traceable, programmable monetary tokens function not only for the public-facing reasons -that is, to streamline payment systems and prevent illicit transfers and money laundering, etc., – but also to enable government* to dictate what you can or cannot do with your money and, from there, to control all aspects of your life. To be sure, these dangers are real and the public’s growing awareness of them is progress.

Central banks, governments, think tanks, and financial analysts argue that CBDCs are needed in order to ensure that national economies remain competitive in an increasingly digitalized and globalized world – one which is also geopolitically fragile and in which terrorism and financial crimes continue to threaten public security. Navigating these global financial transformations in a manner that preserves domestic and international stability requires the specialized policy insight and an overarching perspective that only centralized banking authorities possess. Therefore, nation-states and central banks must ensure that CBDCs are the anchor of the emerging digital currency infrastructure. Moreover, these authorities should develop CBDCs that include verified identity systems in order to prevent dangerous actors from using digital money for illicit activities and to protect legally-compliant digital transactions from vicious interference. As stated in the Federal Reserve’s 2022 CBDC Discussion Paper,

The Federal Reserve’s initial analysis suggests that a potential U.S. CBDC, if one were created, would best serve the needs of the United States by being privacy-protected, intermediated, widely transferable, and identity-verified.

U.S. Federal Reserve, Money and Payments: The U.S.Dollar in the Age of Digital

Transformation, January 2022.

The inseparability of CBDC and identity verification is a key reason why critics caution that CBDC will mean an end to consumer privacy and the culmination of state efforts to erect a total surveillance state.

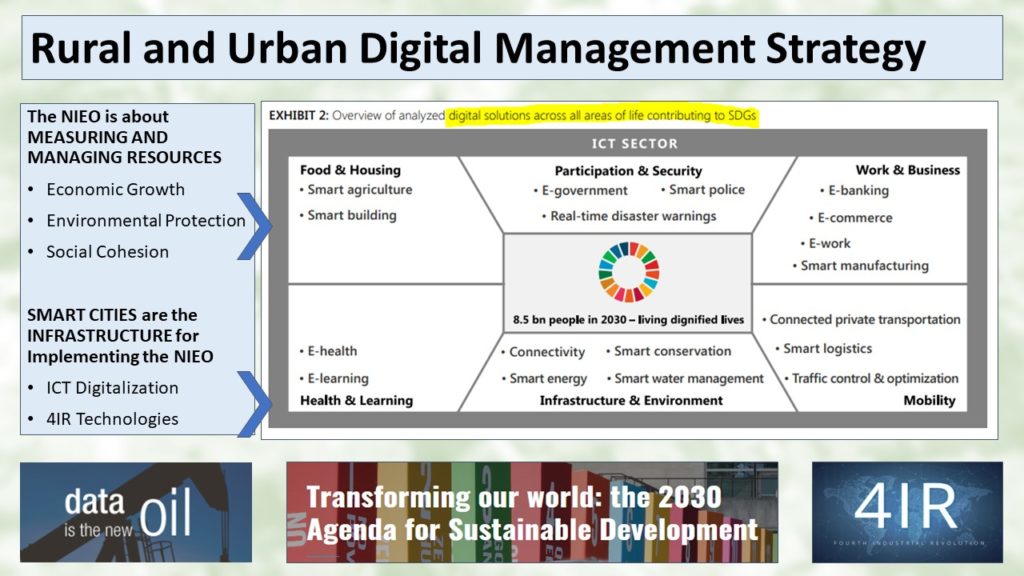

I’d like to suggest here that the growing salience of CBDC’s totalitarian potential has been allowed or designed to occur in order to catalyze public demand for private digital currencies, which are no different from CBDC in terms of their potential to use your data against you and might be even worse from the standpoint of respecting contitutional and political rights. Insofar as private currencies contribute to the disintegration of nation-states and the transition to the new international economic order (NIEO) of governance, they create a system in which AI-calculated bottom-line (or “triple-bottom line“) financials and risk assessments determine what and whose rights deserve protection. I will return to this below.

The rush to develop government-backed CBDCs is, in part, states’ / central banks’ response to the development of cryptocurrencies such as Bitcoin (sometimes referred to more precisely as a cryptoasset), which are digital tokens of commerce, created in the private sector, that provide an alternative medium of exchange to traditional money. Most cryptocurrencies claim to offer users a greater level of anonymity and freedom than conventional payment systems which depend on banks and financial institutions that are regulated by government law and policy. Cryptocurrencies, which are often attractive to those who distrust governmental power (especially after 2020) as well as to those who doubt the state’s capacity to keep apace of larger technological and economic transformations, have their own risks, especially their volatility (owing to their lack of a standard, secured asset to support their value), facilitation of opportunities for tax evasion and illegal transactions, and their potential to undermine national monetary policy and destabilize global financial systems. Moreover, cryptocurrency holders are often limited in their ability to redeem their value because cryptocurrencies lack status as legal tender. Many businesses are hesitant to accept cryptocurrencies as payment due to their being unsecured by a traditional asset or because of underdeveloped cryptocurrency infrastructure.

The dialectic between CBDC and cryptocurrencies has been framed in mutually exclusive terms: between CBDC’s value-stability and state surveillance, on the one hand, or crypto’s volatility and freedom / privacy on the other. Put differently, the narrative has coalesced into two choices: either CBDC’s total centralized control or crypto’s freewheeling, decentralized chaos. Either course would mean a real loss to the average person who wants to conduct his affairs with regularity and without state surveillance and the threat of losing access to his money for arbitrary or ideolgical reasons.

The “Third Way”: Stablecoins

As I have argued before, a monumental Reset of the world’s social, economic, and political order is underway. The Resetters who are endeavoring to accomplish such a feat – the ultra-wealthy, powerful elite who exert unchecked control over governments and geopolitics, global finance, academia and the media, and private corporations – have mastered the technique of the Hegelian dialectic as a means to direct the general population toward this brave, new configuration. The dialectic is a narrative strategy which operates by suggesting to the public eye two opposed and conspiciously problematic alternatives (thesis and anti-thesis) in order to prime the public for a new, “third-way” (synthesis) solution – a solution that promises to preserve all that was desireable in each of the two previous positions, while overcoming all their liabilities.

Stablecoins will not only affect how we conduct traditional payments like remittances but will also enable new forms of commerce previously unimaginable. Stablecoins could become the core building blocks of our future financial architecture.

https://www.cnbc.com/amp/2021/07/13/op-ed-the-future-is-stablecoin-wise-regulation-can-foster-its-growth.html

In the context of the digital currency dialectic, the third-way alternative appears to be the stablecoin, a protocol developed 1) to address the pitfalls of first-generation cryptocurrencies (e.g. their volatility), and 2) to make allowances for some degree of government / centralized banking oversight, without, however, surrendering the privilege of the private-sector to issue and manage digital currencies that, in effect, compete with the fiat currencies issued by sovereign states. According to Investopedia,

https://www.investopedia.com/tech/stablecoin-answer-all-cryptocurrency-problems/Stablecoins are a newer breed of cryptocurrency gaining popularity for their commitment to minimize the price volatility that has limited the use of Bitcoin (BTC) and other digital currencies as a medium of exchange. … Stablecoins promise cryptocurrency adherents the best of both worlds: stable value without the centralized control attributed to fiat.

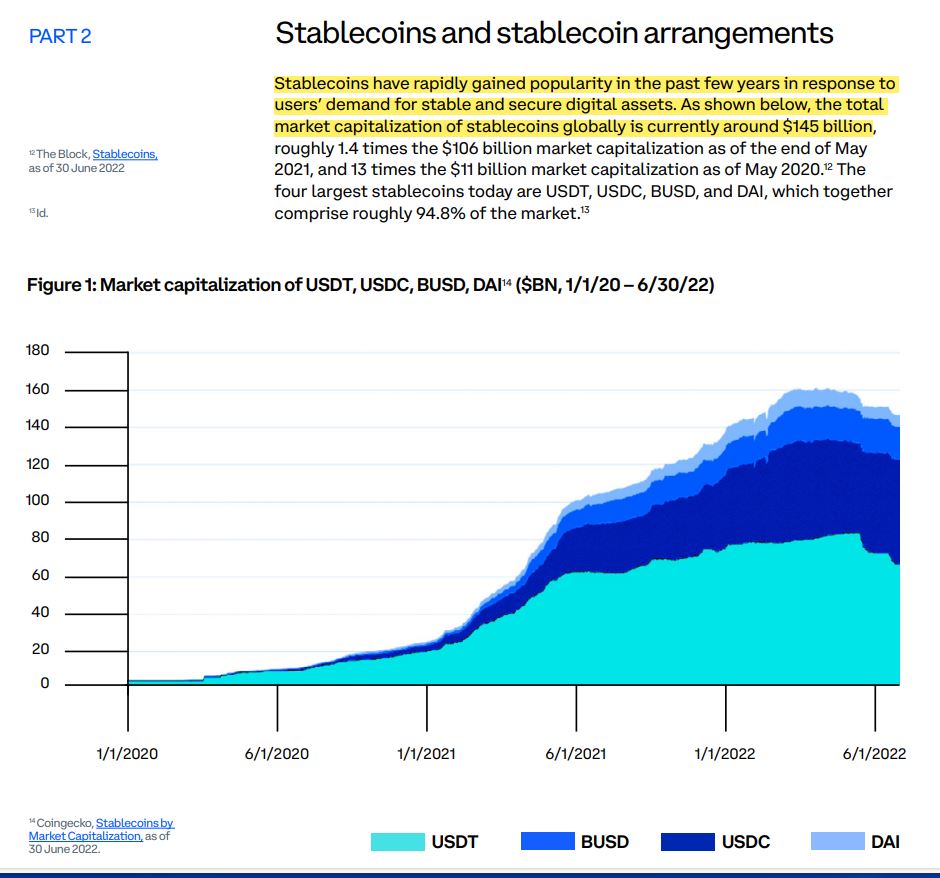

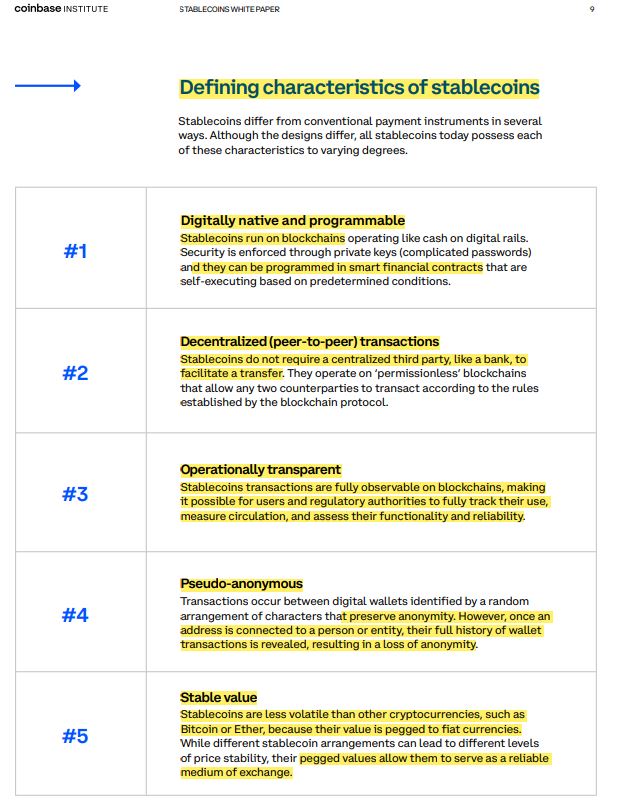

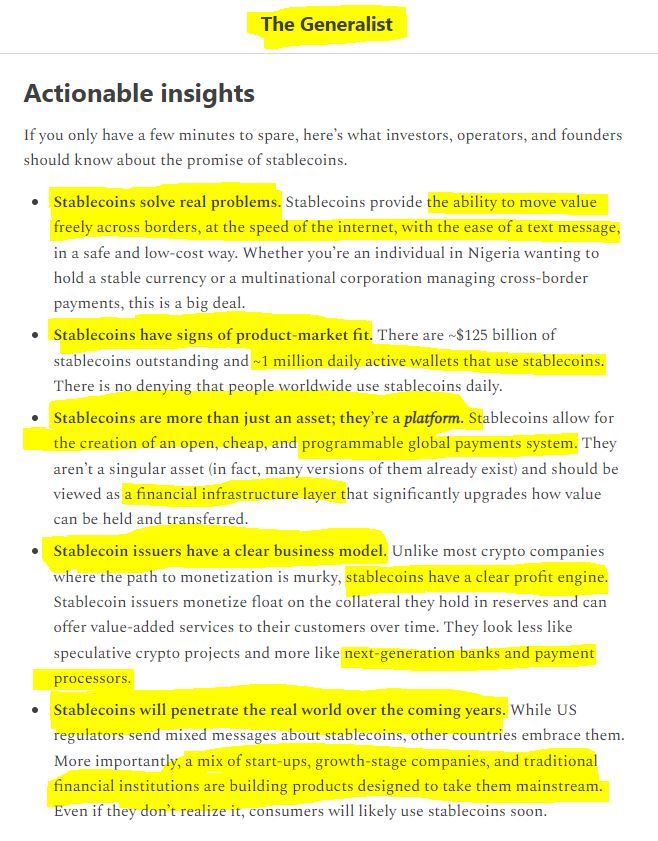

The following screenshots from cryptocurrency giant Coinbase list the key features of stablecoin design and show the rate of stablecoin usage over the past several years. Notice that the phrase “all the benefits of cash without the drawbacks” is repeated three times in the website post – a clear indication that the new cryptocurrency is the third-way solution “of the future.” And of course everyone wants to be included in “the future,” right?

Read the full Coinbase Stablecoin Whitepaper here:

Now let’s examine the landscape of stablecoin features to see more precisely how the dialectic shapes up. Stablecoins are digital tokens designed with requirements for asset-backing or for algorithmic controls to ensure that the coin maintains a predictable value profile. With asset-backed stablecoins, the value represented by the coin is pegged to traditional assets such as gold or shares of stock in a company or fiat currency, to name a few. In this case, the issuer of a stablecoin – whether an traditional bank or a firm specializing in new financial technologies (“fintech”) – establishes a protocol that defines the relationship between the face-value of the stablecoin and the value of some other specific asset or portfolio of assets, so that the price of the coin adjusts to the market conditions of its underlying assets. In the case of stablecoins governed algorithmically, the coin’s protocol fixes an algorithmic control that pegs the supply of its coin to a function of the market price, triggering coin buy-backs or additional coin offerings as needed to maintain a stable supply-to-price ratio. Pegging the face-value of a stablecoin to assets or by algorithm is a process called “tethering.” Tethering is the basis for the claim that stablecoins – unlike first-generation cryptocurrencies such as Bitcoin, whose value is largely a function of the coin’s reputation capital – carry less volatility risk for their users, especially when the coin’s issuers are established financial institutions and subject to public and private regulatory oversight on the level of fiscal and monetary policy.

[Note: I mention algorithm-backed stablecoins here simply to acknowledge one prong of the stablecoin landscape. Coinbase concedes in its stablecoin whitepaper (linked above), “It is now broadly understood that algorithmic stablecoins are not really stable, and it is a misnomer to call them as such. Their value is not backed by exogenous reserves, but based on a tautology – that one token can be converted into another, and vice versa, at a ratio determined by code.”]

Stablecoin issuers are also expected to adopt collateralization policies, which are much like reserve requirements in the traditional banking sector: reserve requirements ensure that banks maintain sufficient cash stores to ensure that account-holders may withdraw funds from their accounts when they wish, rather than at times dictated by the bank’s lending practices. Because stablecoin issuers promise to hold in reserve the fiat currency or other asset that justifies the coin’s price, stablecoin holders enjoy the added security of being able to redeem the face-value of their coins for cash or other assets quickly and easily. Additionally, stablecoin issuing institutions are expected to comply with Know-Your-Customer (KYC) and Anti-Money-Laundering (AML) best practices (more on this below) in order to reduce the danger of illicit transfers and potential tax-evasion, another feature that contributes to growing consumer confidence in stablecoin markets.

“Stablecoins represent one of the most concrete examples of crypto’s promise, protecting individuals against currency devaluation, accelerating and reducing the cost of global payments for businesses, and building infrastructure for a more open, accessible financial system. At a fundamental level, stablecoins aren’t merely a new asset but a radical new platform.”

– Basho, “Stablecoins: the Next Financial Platform,” The Generalist, July 16, 2023

Their proponents argue that stablecoins not only hedge against risks to individual users and to society-at-large, they do so while at the same time offering the privacy from state surveillance and the freedom protections that initially made Bitcoin attractive. (Note: Whether blockchain actually ensures privacy is a topic for another post – I think it does not, as I discuss later. But for our purposes here, let’s take their claims at face-value.) Like Bitcoin and other first-generation cryptocurrencies, stablecoins are private financial instruments that operate via decentralized blockchain networks, such as Ethereum, rather than state-regulated centralized data networks. Therefore, stablecoin transactions may be executed peer-to-peer, bypassing central bank intermediaries and government oversight and reducing the threat of censure or confiscation by those entities. In other words, because stablecoins are designed to operate on the same distributed ledger technology as that which underpinned Bitcoin, they have multiple advantages over a public CBDC, namely, that stablecoin users may expect their transactions to be both secure and private because they operate on trustworthy, decentralized blockchain networks.

“Blockchain” is a term that is largely unfamiliar to the general public, and the technology it describes can be confusing. At the most basic level, blockchain is simply a new way to record and share information through a network of independent, yet synchronized, depositories. A summary post in Bitcoin Magazine clarifies the process and potential of the new technology:

The essential power of blockchain technology is its ability to distribute information. Because it is distributed across all of the nodes, or individual computers, that make up the system, the term “blockchain technology” is often swapped with “distributed ledger technology.” A blockchain’s database isn’t held in a single location, which could be infiltrated or controlled by a single party, but rather it is hosted by numerous (in the case of Bitcoin, tens of thousands of) computers all at once.

The blockchain network automatically verifies itself at certain intervals, creating a self-auditing system that guarantees the accuracy of the data it holds. Groups of this data are known as “blocks,” and as these blocks are cryptographically chained together, the pieces of data get buried and harder to manipulate. Altering any piece of data on the blockchain would require a huge amount of computing power.

https://bitcoinmagazine.com/guides/what-is-blockchain

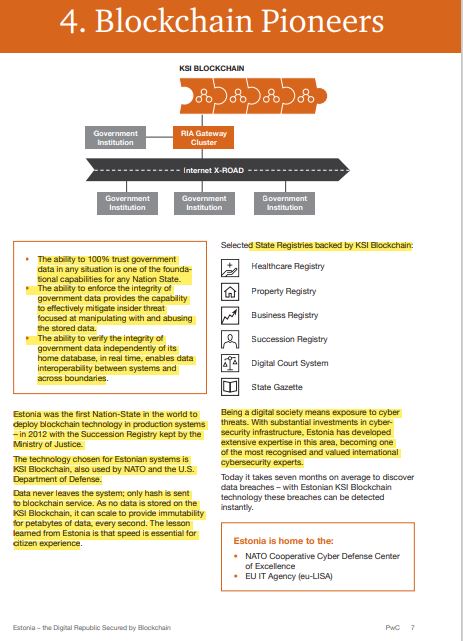

Significantly, blockchain is marketed as an alternative to the legacy systems of information and communications technologies (ICT) that have facilitated a dangerous concentration of power into the hands of established centralized regulatory authorities – especially with respect to power over data. The architecture of blockchain, its champions claim, guarantees the security of the data recorded to it and prevents unauthorized agents from writing or re-writing the books, so-to-speak. The decentralized structure of the network is the basis for claims that it is “democratized” and, therefore, acts as a barrier to manipulation by those who already wield tremendous control over resources, narratives, and money. The democratization of data security and integrity via blockchain opens up opportunities for individuals and small businesses that were previously available only to the large firms who could afford the costs of protecting their ICT networks. Touting the benefits of blockchain for small enterprises, the U.S. Chamber of Commerce lists “creating non-fungible tokens,” “raising money in new ways,” and “showing how products are sourced.” And in a summary note to small businesses, the Chamber recommends blockchain-based cryptocurrency payments as being less susceptible to malicious interference by hackers than other electronic settlements:

Cryptocurrency is considered more secure than credit and debit card payments. This is because cryptocurrencies do not need third-party verification. When a customer pays with cryptocurrency, their data isn’t stored in a centralized hub where data breaches commonly occur. Rather, their information is stored in their crypto wallet. Plus, the blockchain general ledger is used to verify and record every transaction, making it very difficult, if not impossible, to steal someone’s identity.

https://www.uschamber.com/co/run/finance/accepting-cryptocurrency-as-payment

We see, then, that the “third-way” Stablecoin Solution to the CBDC vs. Cryptocurrency Dialectic rests heavily on the assurance that blockchain technology will ensure a highly-secure, or trustworthy, system for transferring digital assets of value (cryptocurrencies) from one party to another. And – because its security and trustworthiness derive from its decentralized design (its structure) rather than a guarantee (a promise) by a state or other centralized authority – blockchain technology appears to protect against intrusive meddling with that information by governments or other entities. Therefore, blockchain-based currency systems are pitched as the means to enable individuals and small enterprises to break free of traditional systems and rules, to contract with each other directly in new and innovative ways, and to bypass all sorts of social, political, and financial barriers to the golden ticket: opportunity.

The Trust Dialectic: Old Blocks and New Chains

It is no exaggeration to say that blockchain is one of the most “disruptive” technologies of our time. Its capacity to create a permanent digital record of any and all information pertaining to any and all resources (real or virtual or imaginary) is revolutionizing finance, business, geopolitics, accounting, data-management, predictive analytics, and communications in ways that are too numerous to list here. Suffice it to say that the most ardent supporters of the blockchain revolution – powerful and influential representatives of multinational corporations, think-tanks, business and professional organizations, academia, government, and social and activist organizations – celebrate its potential to usher in a bold new era characterized by the values of sustainability, equity, resilience, safety, inclusivity, transparency, and accountability. Or, in other words, to launch the Reset.

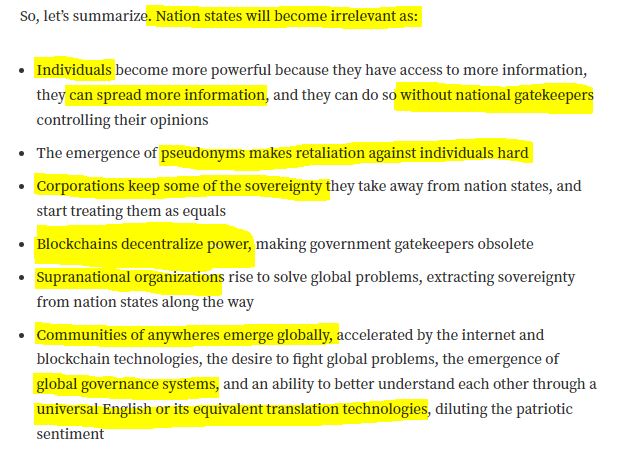

Conspicuously absent from most of the glowing, buzzword-laden visions of a blockchain-better world (or, at least from those presented to mainstream audiences), is a candid discussion of how blockchain undermines the modern system of nation-states and the very idea of constitutional government – both of which are among the primary organizing forces of contemporary societies. This silence is telling, and a closer examination of the development of blockchain technology reveals that it was designed not so much with the goal of liberating the average person from oppressive structures as it was for upending traditional sovereign states in order to implement technology-based networked global governance. Global governance differs from constitutional government, inasmuch as governance is a regulatory regime overseen by stakeholders – by private or quasi-private entities, especially financial and business entities that stand to benefit from the new regulations – whereas government by sovereign states operates through laws and institutions whose authority (at least on paper) derives from and is accountable to the people of those states.

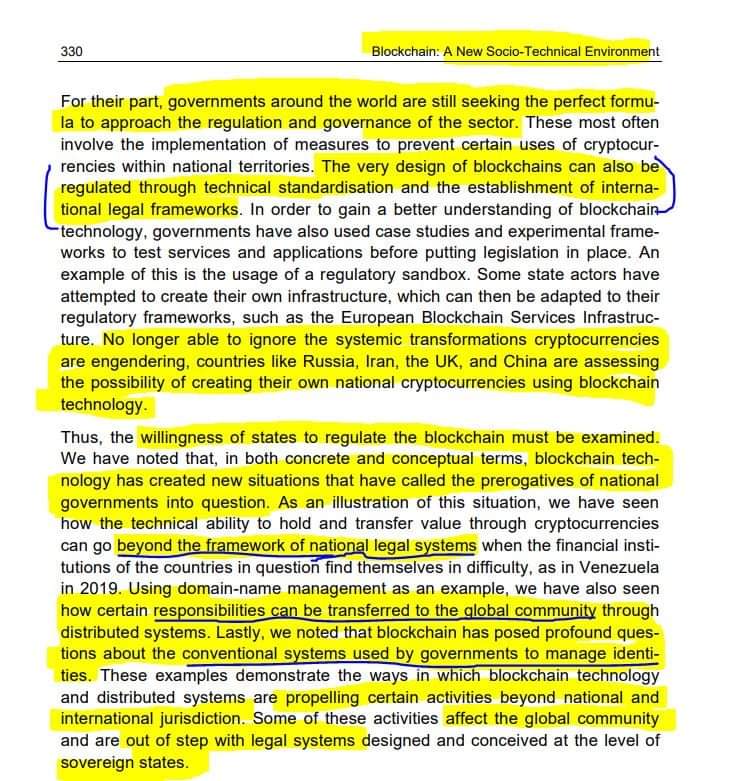

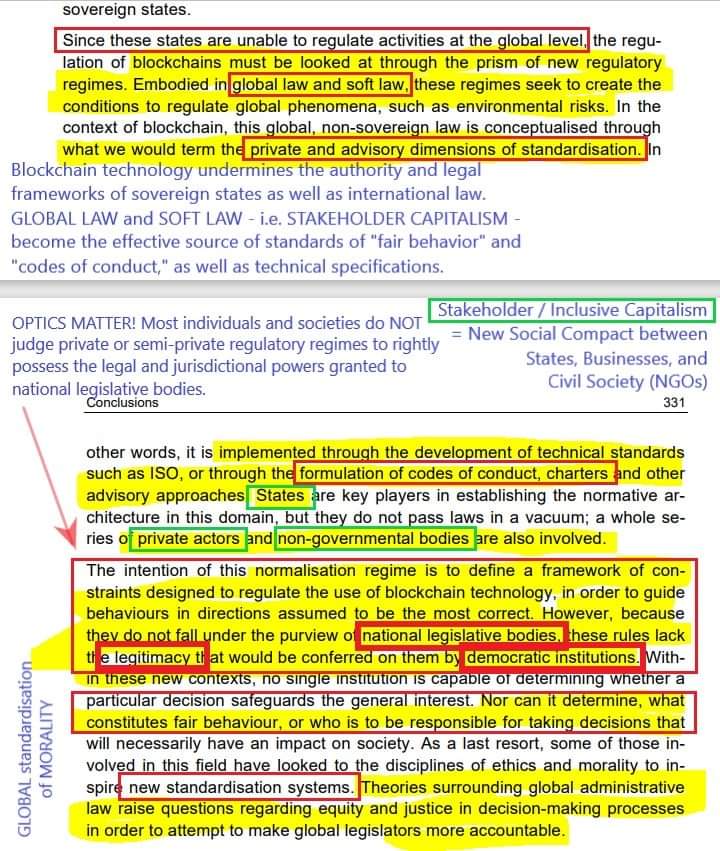

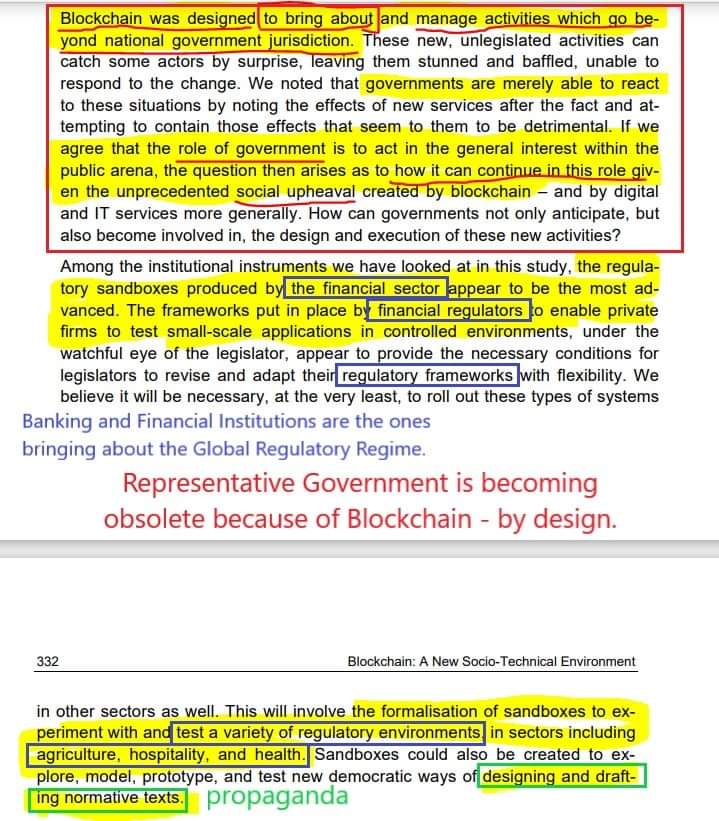

The impact that blockchain technology is set to have on the existing system of nation-states is discussed in detail in the e-book Blockchain: Capabilities, Viability, and the Socio-Technical Environment, published in 2020 and linked below with annotated screenshots. The collection of articles, written by high-level consultants from the banking, ICT, and regulatory sectors, contains a history and explanation of blockchain technology as well as insights into its implications for existing nations–especially their ability to determine fiscal policy. Importantly, the study places national institutions squarely in the reactionary camp, claiming that blockchain has enabled the emergence of economic frontiers that burst the capacity of conventional legal frameworks and lie beyond national jurisdictions. The authors argue that new, global institutions with expanded regulatory authority are therefore needed in order to bring stability and fairness to the new blockchain-enabled global economy and to direct it toward ends that are decided to benefit the global community.

The study considers public opinions surrounding governance in general and suggests that the new regulatory frameworks needed to address the “social upheaval” wrought by blockchain would find greater public acceptance if they were promulgated by the national “democratic” institutions with which the public is most familiar, as opposed to unfamiliar global governing bodies, which do not enjoy the same degree of public trust. The authors go on to say that the familiar national institutions are constrained by laws and other considerations which pose intractable obstacles to their ability to develop successful policy resposes to blockchain-based transformations. Soft law, corporate policy, issuances of standard practice, partnership agreements, and other private-sector initiatives are therefore the critical fields for introducing and enforcing regulations that otherwise would meet with delay and opposition from public institutions. In short, blockchain technology presents the world’s nations with challenges that they are unable to navigate and which will, in the end, require a divestiture of authority to global policy-makers, administrators, and technologists.

The scope of transformation projected is difficult for the average person to imagine, but it’s one that the “innovators” in finance, technology, and governance speak about openly amongst themselves. See, for example, Politico‘s coverage of The Networked State, a book written in 2022 by former Coinbase executive Balaji Srinivasan. The book builds on Srinivasan’s remarks at the 2017 TechCrunch Disrupt conference, a key theme of which was the opportunity for technology firms to assume responsibility for filling the “gaps” left by government policy:

“Srinivasan’s vision for the future is more ambitious. In it, people build online social networks around a shared social vision (like life extension, or greater income equality), and eventually group together in pockets of physical land in the real world, forming internet-linked archipelagos. They also use cryptocurrency, keep records with blockchains, stake out their own slices of the Metaverse, and eventually win diplomatic recognition from existing nation-states. This vision culminates in what Srinivasan, a vocal critic of both American and Chinese political elites, calls a “recentralized center.” In other words, network states come together and take over the world.“

https://www.politico.com/newsletters/digital-future-daily/2022/07/21/technology-vs-the-nation-state

Of course, many of the champions of Bitcoin knew this all along and, as demonstrated in the article below, they unabashedly support the sea-change.

“The more that blockchains power the economy, the harder it will be for nation-state governments to track all of these money movements, and the harder it will be for them to tax these movements. … Today, the way governments do it is by regulating local banks, by getting direct data feeds from them, by intervening the international money flows through the SWIFT system, by freezing assets… But how do you do that in a world where all exchanges are decentralized?“

https://bitcoinmagazine.com/culture/bitcoin-and-the-end-of-nation-states

One must wonder if the demographic which would prefer a stablecoin (emphasis on the “stable”, with its tethering to state- /central bank-backed fiat currency) to investments in riskier cryptocurrencies would also be willing to accept the dissolution of the nation-state? My hunch is that such is not the case. After all, what happens to the value of a stablecoin when the state responsible for establishing the worth of fiat currency becomes obsolete? Or to the national economy if the stablecoin market outstrips the market for fiat currencies? If nation-states give way to private global regulation, could the value of a stablecoin exert pressure on the value of the fiat currencies that are supposed to guarantee the price of the coin? How such questions are answered has the potential to reshape drastically the social, legal, and political orders to which we are accustomed.

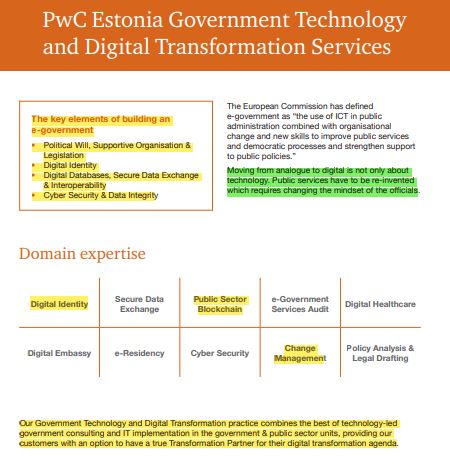

On a more practical level, won’t many stablecoin holders be concerned over the general consequences that erosion of national institutions will have, for example, on long-standing entitlement programs – Medicare or Social Security, for example – and other government services (FDIC or OSHA)? This is to say nothing of the possible attenuation of constitutional rights – the liberties and freedoms that government is established to secure – or the potential abandonment of the principle that just government derives from the consent of the governed. Are we ready to follow the example of Estonia, the world’s most advanced digital republic, into the era of the “networked state”?

It is on this point that we see how the dialectic of digital currency intersects with another instance of dialectical nudging: that of public trust, and whether it is to be placed in the old nation-state or its anti-thesis–the emerging networked state. As we saw discussed in the Blockchain e-book, public trust is a critical subject because of its role in determining which entities are perceived to have legitimate authority to govern – both in terms of issuing rules and enforcing compliance with them. If their operations are grounded in a solid reserve of public trust, governments, businesses, and other organizations may expect to receive the inputs that are necessary for their long-term stability, namely, the public’s acceptance of and compliance with their rules and terms and the public’s financial and in-kind support for their enterprises. In general, the public tends to place its trust in what it knows over the uncertainty of novel solutions (hence the ubiquitous marketing campaigns in support of “innovation”). Even the U.S. Declaration of Independence states that, “all experience hath shewn, that mankind are more disposed to suffer, while evils are sufferable, than to right themselves by abolishing the forms to which they are accustomed.” Therefore, in order to transform the existing system of sovereign nation-states so as to capture the potential of the blockchain revolution to create a sustainable, resilient, transparent, etc. world, the Resetting elites must create a narrative that incrementally shifts the public trust away from the old and toward the new through a dialectic strategy. Within this narrative, the “third-way” solution of global governance appears to coincide with the principles of existing national, constitutional structures. By securing the appearance of compatibility with familiar, publicly-accountable institutions, global governance acquires a share of legitimacy and public trust that it would otherwise lack. The point is worth emphasizing: navigating the optics is of crucial importance.

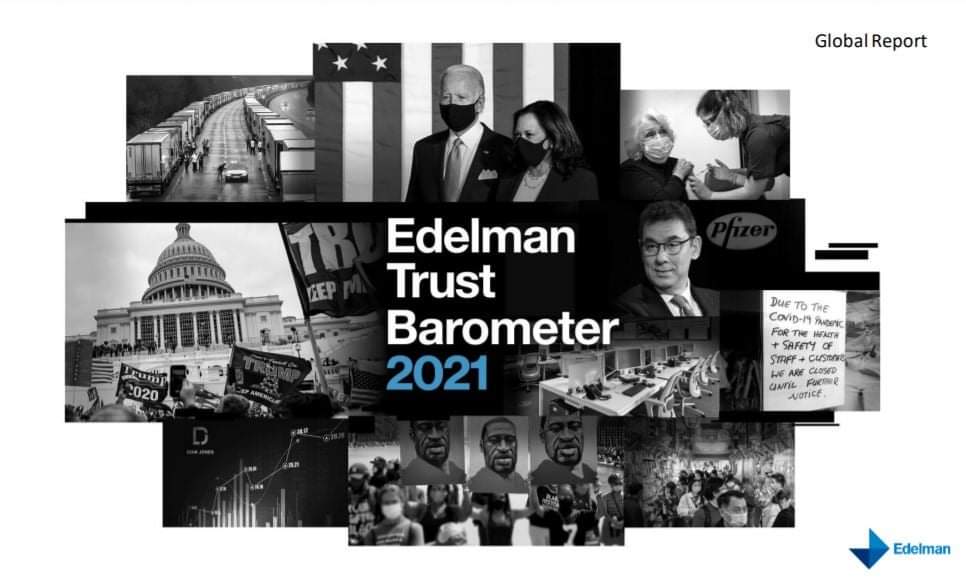

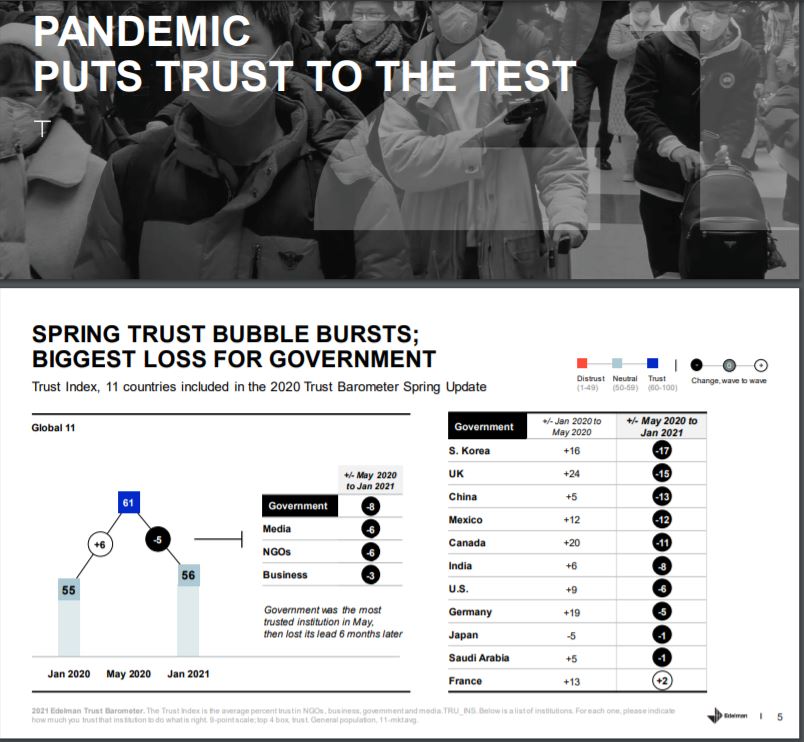

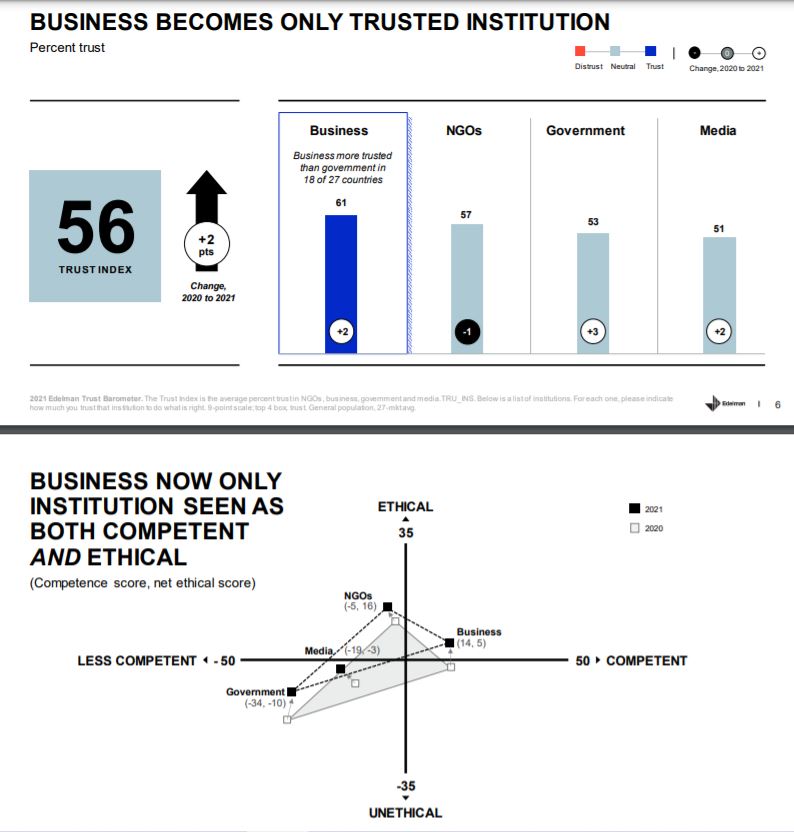

The Edelman Trust Barometer Report, published in 2021, provides an excellent example of the Resetters’ technique of nudging public opinion on trust toward a third-way solution. Although this report is not explicitly concerned with blockchain technology, it is an example of the kind of “normative text” that the Blockchain e-book recommends (see screenshots) in order to prime the public for a world that is quickly moving beyond the nation-state. The Trust Barometer tells a narrative of 1) a problem: namely, the public’s waning confidence in traditional governments’ ability “to solve the world’s pressing problems” (to use one of the Resetters’ stock phrases) – and 2) a solution: the public’s new evidence-based trust in businesses – and employers in particular – as the ethical agents who are able to deliver solutions where governments fail to do so, especially in the increasingly globalized and digitalized world.

The narrative effects a subtle, yet critical, shift in the architecture of public trust as a concept: whereas a common-sense appraisal would likely identify the basis of public trust in historical experience (custom, familiarity, regularity, etc.) or in reference to normative theory (of law, justice, constitutionality, e.g.), the Trust Barometer posits public trust as a function of an institution’s success in materializing a specific set outcomes, results, or deliverables – all of which echo the themes of the Reset and the UN Sustainable Development Goals. That the Trust Barometer’s narrative of public trust 1) glosses over significant distinctions in institutional organization and purpose, 2) neglects alternative accounts of the pressing problems and their solutions, and 3) characterizes “the public” in unilateral terms, are indications that its account is pure propaganda–charts, graphs, and data notwithstanding.

Importantly, most Resetters do not openly advocate for the complete devolution of the world’s existing governments into digitialized networked states – a proposal too radical for most people and one that would certainly arouse public scrutiny of the Reset agenda. Rather, the suggested way forward is to enlist businesses and the private sector in the effort to rehabilitate and ennoble governments through partnerships in which businesses lend their expertise and problem-solving capacity to government institutions for the benefit of all. In other words, the Resetters propose a seemingly moderate third-way approach: for governments to regain public trust and to deliver the solutions that the people demand (or such is their claim) will depend on “reimagining” governments as public-private partnerships. What this means is that the force and authority of government may be directed according to the enlighted perspective of private business and “civil society” organizations that have the technological and operational capacity to usher in solutions on a grand scale. Marrying the two – 1) existing government forms and the public trust that has supported them with 2) the innovative vision, efficiency, and technological capacity of the private sector – in a third-way public-private partnership (or “P3”) avoids the public outcry that would certainly accompany an explicit proposal to enter the era of the networked state. Instead, the moderate-appearing P3 makes what is actually a grand-scale transfer of public authority to the private sector appear to be consistent with conventional governments and the principle of popular sovereignty which is (generally speaking) at the core of most Western constitutional systems. This sleight-of-hand is the means by which the private-sector Resetters co-opt public confidence in and compliance with a variety of “reimaginings” that all tend toward the new era of the networked global state. And promises to deliver built-back-better outcomes are the carrots that entice the public to place its trust in these partnerships.

Stablecoin Regulation: a Narrative of Public Trust, Technology, and the New Economy

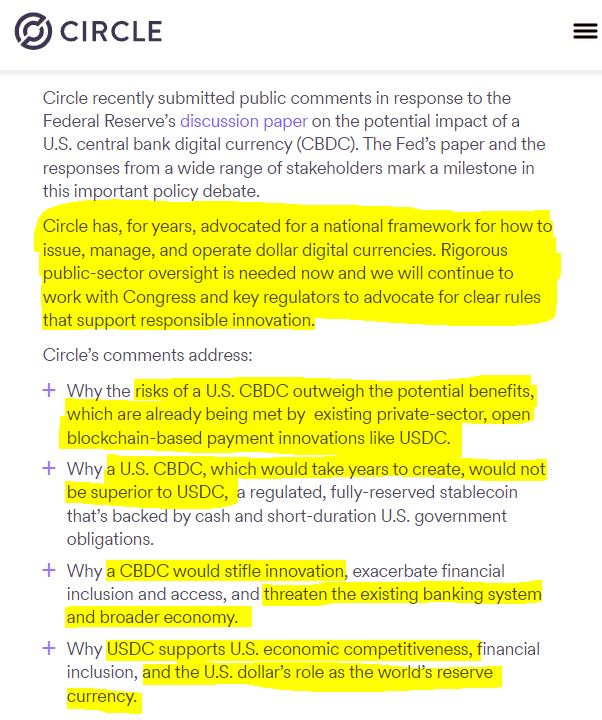

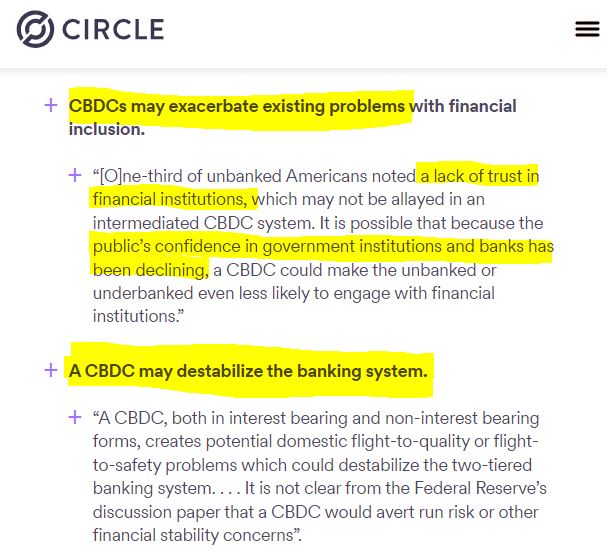

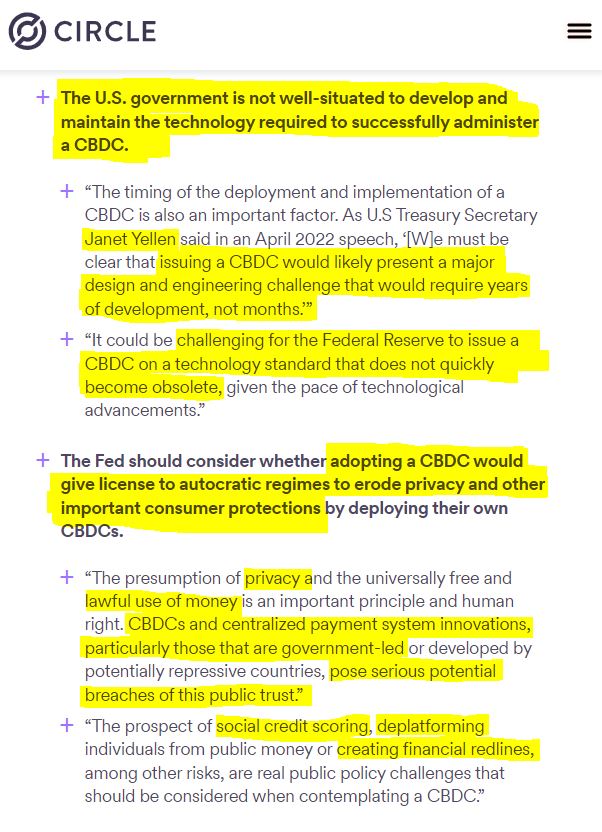

In order to demonstrate the interconnectedness of the dialectic of digital currency and the dialectic of public trust, we have only to examine the dynamic emerging around stablecoin regulation, in which the model of state-/public- and private-sector collaboration features prominently. Take, for example, the points highlighed in the following screenshots from a response issued by Circle Internet Financial, one of the largest stablecoin developers and a partner with Coinbase, to the Federal Reserve’s CBDC Discussion Paper.

Here, Circle, the issuer of the USDC and EURC coins – stablecoins tethered to the U.S. Dollar and the Euro, respectively – follows the pattern we observed in the Trust Barometer: 1) calling into question whether government is fit to be trusted with the administration of digital money and 2) arguing that the private sector is willing to cooperate with and lend its expertise to the public’s legacy system in order to 3) implement a trustworthy solution that secures the best of both worlds.

It is not just stablecoin issuers – who presumably have something to gain – that proffer this and similar narratives. As the International Monetary Fund (IMF) put it in one of its blog posts, “The public and private sectors should continue to work together to provide money to end-users, while ensuring stability and security without stifling innovation. Banks could come under pressure as specialized payment companies vie for customers and their deposits, but credit provision must be sustained even during the transition. And fair competition must be upheld—not an easy task given the large technology companies entering the world of payments.”

Closer to home, FinExtra reported in 2020 that the U.S. Office of Comptroller of Currency gave its approval for federally-chartered banks “to hold stablecoin ‘reserves’ on behalf of customers who issue certain stablecoins.” And more recently, the U.S. Congress took up the subject in a Hearing entitled, “Putting the ‘Stable’ in ‘Stablecoins:’ How Legislation Will Help Stablecoins Achieve Their Promise” As the name implies, collaboration between government and private-sector stablecoin issuers is to be a pillar of the way forward.

See also, for example, what Charlene Fadirepo, “a financial empowerment speaker, a Bitcoin activist and former US regulator with 15 years of experience in the traditional finance world,” has to say about the obstacles that would beleauger a successful effort by the U.S. government (via its central banking system) to address the challenges posed by the blockchain revolution in global payment systems. Her remarks are clearly positioning for the private sector to deliver a solution that is beyond the capacity of public institutions acting alone:

“Plus, having spent nearly six years of my 15 year banking career at the Federal Reserve Board of Governors in a bank supervision audit capacity, it is also clear that many politicians have severely underestimated the legal, compliance, financial, technology and regulatory administrative burden required to launch a central bank digital currency in the United States, not to mention the onslaught of congressional hearings and the passage of a specific CBDC law that would be required for a digital dollar to go live.”

https://blockworks.co/news/fednow-cbdc-save-us

No matter the sector, topic, or audience, the narrative pattern that consistently arises in studies, reports, articles, press releases, whitepapers, and all sorts of other marketing materials is clear: governments lack the vision, speed, expertise, and agility to navigate digital transformation and Globalization 4.0 – therefore, the private sector must step up to the plate just as it did during the public health emergency of 2020. This time around, it is the financial technology firms that have the opportunity to partner with governments to ensure that the latter is equipped to sanction private-sector solutions to the problem of an unsustainable economic order.

Building Back Better: Partnerships and the Economy of Trusted Identity

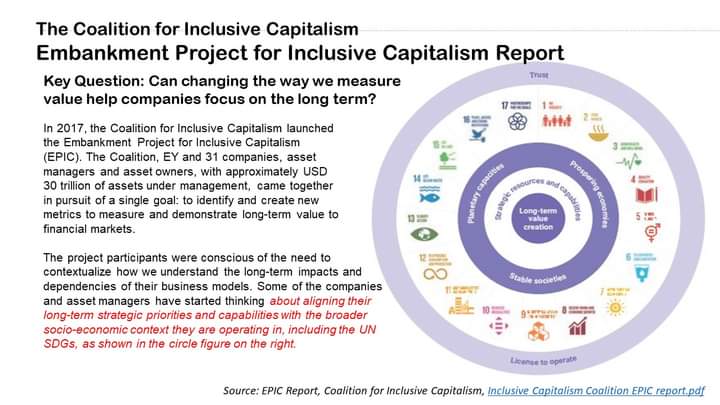

In January 2024, stablecoin-developer Circle Internet Financial participated in the World Economic Forum’s Annual Meeting in Davos, the theme of which was “Rebuilding Trust.” The WEF is a partner of the United Nations and one of the most influential organizations in advancing global policy initiatives through collaborative, innovative partnerships between government, business, and civil society. One of the WEF’s signature initiatives is Inclusive Capitalism, which it advocates as a “new social contract” based on a reinvention of society, politics, and the economy and aimed at universal prosperity and planetary health. At this meeting, an “array of Fortune 500 firms… engaged with [Circle’s] leadership team,” and Circle executives presented at several events, all focused on the emerging internet financial system and how it may contribute to rebuilding the economy. According to Josh Burek, Circle’s Senior Director of Strategic Positioning, “a healthy economy runs on trust. Every transaction depends on it. To invest money is to trust in the future. To spend it is to trust in a good or service. To send it requires trust in the transmission.”

Circle’s approach to building the trust economy is twofold. First, Circle is committed to working with Congress and other public authorities as it continues to promote the private stablecoin market. As stated in its Response to the Federal Reserve’s CBDC Discussion Paper, “Bringing stablecoins like Circle’s USD Coin (“USDC”) under common-sense regulatory guidelines would ensure proper supervision over an asset that is already achieving many of the Federal Reserve’s objectives in a potential CBDC. In the longer term, the ability for existing blockchain-based payment system innovations to meet their maximum potential will be greatly enhanced once Congress passes a federal framework for regulating all digital assets.” Circle’s proposals for collaboration with government regulators include (among others): the development of clear rules and standards for regulating digital currencies, consideration to grant legal tender status to stablecoins, supporting the global competitiveness of the U.S. Dollar through private innovation, and countering financial crime. Circle even suggests that the Federal Reserve could serve as the custodian of its coin’s underlying reserve assets.

Importantly, Circle’s proposals for collaborating with public authorities – all of which aim at building the trust economy – are presented in contexts (its Response paper and at the WEF meeting) that also explicitly highlight 1) the government’s inability to provide solutions needed in the digitalized and globalized economy, 2) the public’s growing distrust of government and traditional banking institutions, 3) the numerous accomplishments of private-sector partnerships to drive innovation and address risks, and 4) Circle’s committment to create societal value through ESG- and SDG-aligned investments. This is a paradigmatic example of the convergence of the digital currency dialectic and the public trust dialectic, aimed at a soft privatization of the nation-state and its monetary authority.

The second prong of Circle’s approach to rebuilding trust is to develop, for its part, an internet financial system that is based on the pillars of “openness” (especially “open money”) and “interoperability.” What these terms mean for those who understand the language of the Reset is that the system is based on blockchain technology – the permanent digital ledger of any and all transactions recorded to it. Burek goes on to say that:

“For us, this effort begins by being open about who we are, what we do, how we do it, and why we do it. It’s embedded in our programming, emblazoned on the walls of our Promenade storefront, and enshrined in our values.”

https://www.circle.com/blog/at-davos-circle-opens-doors-to-the-open-money-era

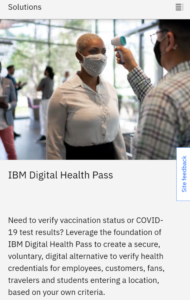

While this statement might seem to be simply an innocuous – if grandiose – instance of ordinary corporate promotion, there is much more to it than that. Burek emphasizes the outward proofs of Circle’s openness as guarantees of the company’s programming. One of his implications is that verified identity – and the corporate-controlled technological infrastructure upon which it is based – is the primary building block of the trust economy. Blockchain-based proof-of-identity is the foundation of the new economic order championed by Circle, the WEF, and the vast array of corporate partners that support a policy of “Reinventing Capitalism.” It is no surprise, then, that one pillar of Circle’s business is a universal digital identity platform, developed in partnership with other major financial and technology firms. Circle’s Response whitepaper states the following:

“Circle has established key partnerships to help combine some of the best practices of well-regulated, traditional financial and payments institutions with the inherent benefits of open, public blockchains; collaborations with BlackRock, Visa, Mastercard and Worldpay are just a few examples.”

“Circle’s deep expertise operating USDC has also led to innovations that have the potential to address problems that have plagued society, in particular the challenge of verifying digital identity. About one billion people globally face challenges proving who they are, limiting their ability to access basic services and economic opportunity. In recent months, Circle has worked with Block, Coinbase and the Centre Consortium to develop Verite, a set of free, open source decentralized identity protocols and data models that allow people and institutions to cryptographically prove claims about their identities. Verite has the potential to reduce friction, protect privacy and increase compliance with Know Your Customer (KYC) and anti-money laundering and countering the financing of terrorism (AML/CFT) controls.”

“Circle has, with other partners in the industry, developed Verite, a digital identity model that would provide a verifiable and proven identification that is scalable, usable by anyone, and interoperable across systems, while also providing individuals with the certainty that only the minimal amount of information is shared (to protect their own privacy).”

Universal digital identity is the real prize of the digital currency dialectic, and companies like Circle know that transforming global systems of finance and currency through the introduction of stablecoins is a crucial step toward creating a new economic system built on the “trust” that accompanies verified-identity-linked data. A post on Circle’s website observes that the 2024 Davos meeting confirmed “a growing convergence of stablecoin infrastructure with traditional banking, finance, payments, and aid.” And it goes on to quote Circle’s CEO Jeremy Allaire in saying, “The mainstream phase of this [growing convergence] is one in which you’ve brought together regulation, traditional finance, and blockchain technology and leading crypto players that can connect those worlds together.” What Circle executives, Fortune 500 firms, and the World Economic Forum are developing through the vehicle of stablecoins is nothing short of a complete overhaul of the global financial system and, which goes along with it, the international system of nation-states.

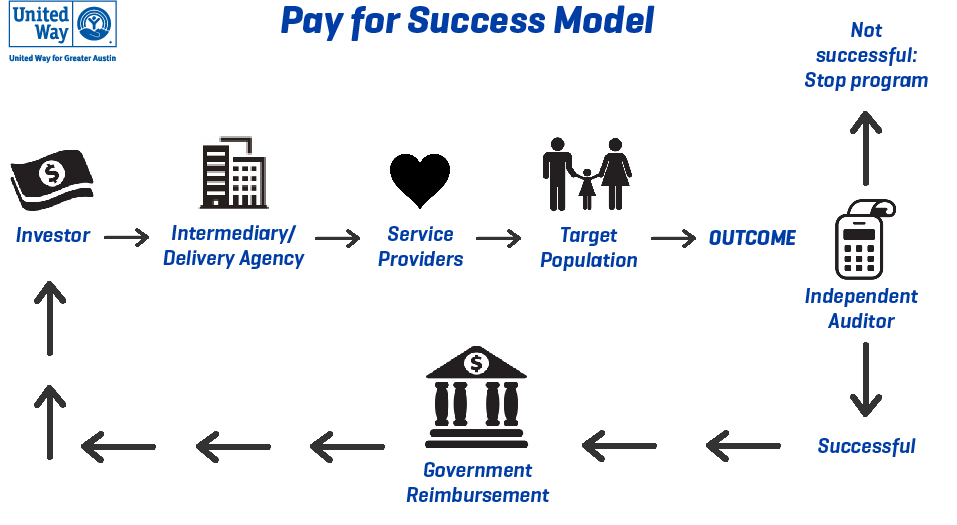

The emerging financial and economic system envisioned at Davos is based not on the exchange of money, but rather on identity-linked data. Private-sector financial technology firms are in the business of changing payment systems so that money, as most people understand it, and the sovereign states that have, until this point, been the primary issuers of it, become relics of the past, superseded by socially-responsible corporations that determine what outcomes constitute “true value” in a built-back-better world. In lieu of money, you will pay (or pay it forward) with your behaviors – behaviors that create the sort of corporate “value” that Circle’s spokesman alluded to in his remarks at Davos and which guides the company’s Impact venture, that the Trust Barometer took for granted, and that are repeated ad infinitum in whitepapers on Inclusive Capitalism, the Sustainable Development Goals, and myriad transformation policy briefs. To this end, the Resetters must – incrementally, so as not to fluster the public or lose its trust – work toward the sunsetting of nation-state-promulgated currencies before this transformation can take full effect.

The third-way solution of state-regulated stablecoins is the opportunity to make national fiat curriencies and the nation-states that issue them, obsolete, thus paving the way for a system of exchange in valued-behaviors. After having first partnered with nation-states to develop stablecoin regulatory frameworks and then slowly assuming their authority to issue currency and the public trust attached to that authority, the private fintech companies will be in a position to transition from fiat-backed stablecoins to stablecoins referenced to an individual’s concrete compliance with corporate stakeholder values. The digital identity infrastructure that undergirds stablecoins and other cryptoassets is the backbone of tracking, tracing, and enforcing this compliance. It should be noted here that whatever the stakeholders value will change capriciously in response to consumer/community preferences. Where nation-states manipulated the quantity of money (used to register one’s perceptions about what is most desireable), the Resetters will manipulate (through marketing and corporate culture development) the meaning of “value” so that bartering in behavior-outcomes-securitized tokens may become the currency for the new financial system.

Such a radical transformation may sound far-fectched, but its motions are already well-underway, both in terms of technology development and the coalescing of values-oriented partnerships between public governing entities and private-sector firms. Regarding technology capabilities, private-sector-issued stablecoins are enabled with smart contract functionality and have the programmability features of CBDC – and then some, as we read in Coinbase”s whitepaper (second screenshot, from paper linked above):

Stablecoins, therefore, have all the surveillance and controls of a public CBDC, but without the accountability to the public that a legal audit provides. Moreover, under the auspices of compliance with public Know-Your-Customer and Anti-Money-Laundering regulatory requirements, stablecoins carry the same verified identity information that has caused significant concern among critics of CBDCs. Below, I have linked the UN’s report on combatting financial fraud, which outlines how “hybrid co-regulation” of private currencies supports the openness and transparency of financial flows in a world that is increasingly without borders. The same basic principles are also written into Circle’s response to the the Federal Reserve paper on CBDCs, discussed above. When we consider the firms that manage Circle’s USDC coin – notably BlackRock – we are left to wonder whether a private-sector surveillance regime might not be even worse than a state surveillance regime.

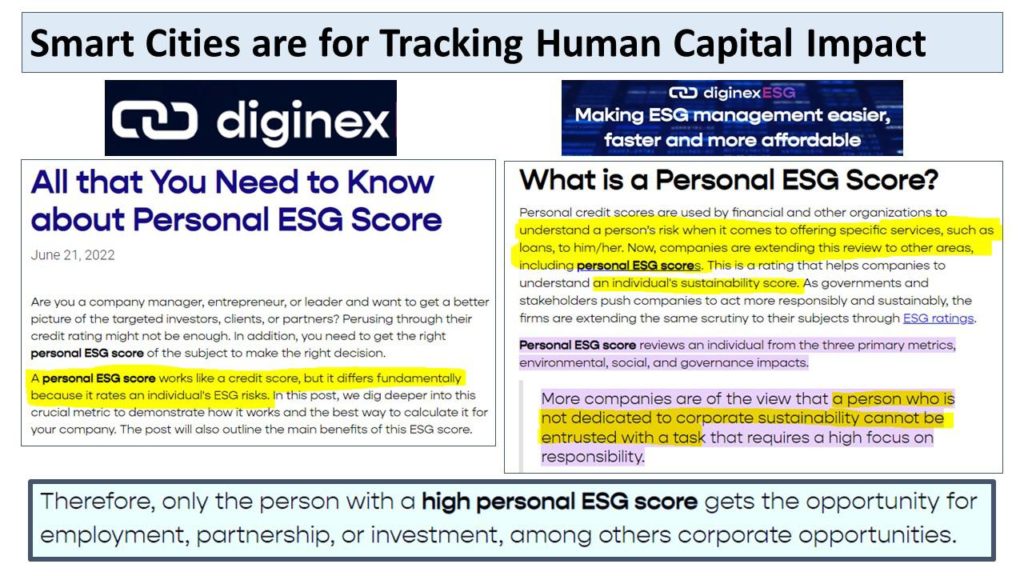

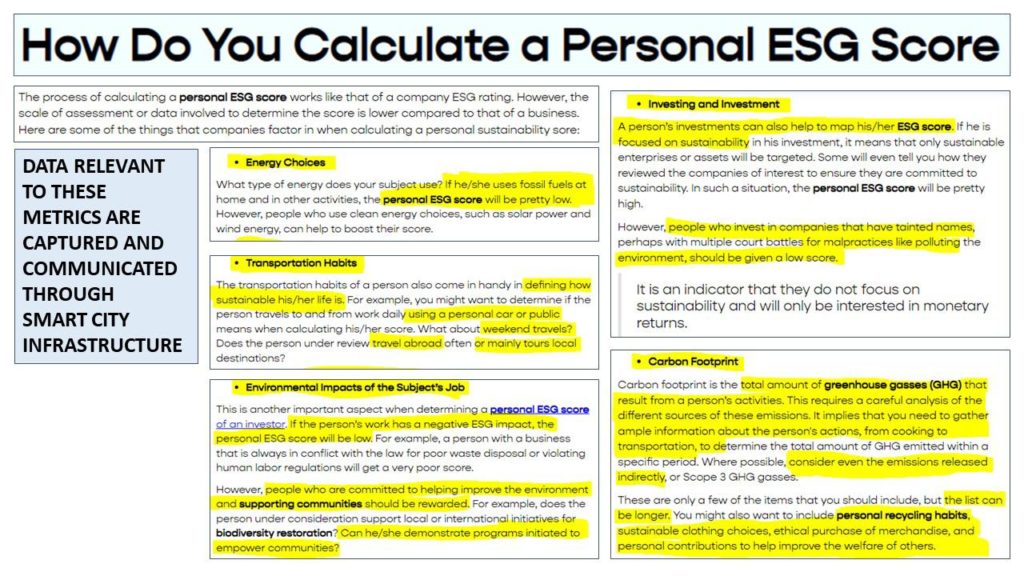

Stablecoins are in the custody and under the management of the multinational banking and financial services conglomerates that already exert immense control over national governments and influence social and corporate initiatives through their partnerships with the WEF and other roundtable organizations. As a result, private stablecoins will likely evolve to have ESG-strings programmed into their protocols, making stablecoin transactions conditional upon the ESG-compliant behaviorial norms that are increasingly embedded into corporate strategy and mission-development. The business of ESG scoring is to link profits to “proof of impact”–that is, verified performance data gathered through a system of connected sensors and data-collection technologies in conjunction with blockchain-based identity credentials. Because stablecoins like Circle’s USDC have smart contract programmability and employ verified digital identity technologies, it is easy to imagine a scenario in which an individual who wishes to complete some transaction or receive payment in stablecoin currency may first have to complete ESG-related behaviors or disclose personal information in order to prove his alignment with private-sector corporate values. This is only the tip of the iceberg when it comes to unpacking the trajectory of the digital currency dialectic.

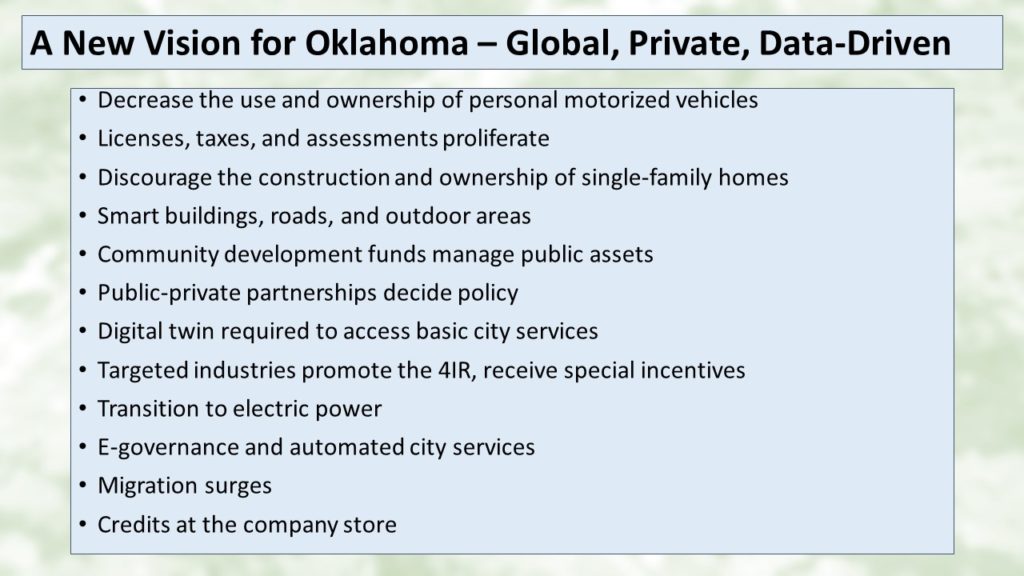

The NIEO is a globalized, privatized, data-driven system for measuring, managing, and monetizing your behavior – a social engineering program of epic proportion that operates through automated, networked systems that gather, share, analyze, and control data. No longer will the sluggish, messy, and oppositional process of representative politics and law-making govern the people of the world’s various nations and their concrete struggles to manifest justice. Rather, what the Resetters hope to accomplish is a society transformed by the extreme technologies (including blockchain) of the Fourth Industrial Revolution and the 21st-century mindset of global citizenship, in which the good of the planetary community is defined by visionaries in the private sector and to which individual rights are subordinated. Data gathered from ubiquitous sensors, sophisticated analytics and prediction-modeling programs, behavioral nudges delivered through the Internet of Things and Bodies, and infrastructure systems designed to optimize the performance of and manage access to all resources are the cornerstones of a new rules-based global order that enshrines economic development as the universal and preeminent value. All other principles – such as justice – that (if only in civic myth and obligatory talking points) gave legitimacy to sovereign governments are, in the context of the networked state, reduced to economic calculations which are rational because they are neatly quantifiable in terms of inflows and outflows. That is in stark contrast to the lofty, yet abstract, ideals that have always generated more questions than answers and are often at the heart of intractable conflicts within the body politic.

I discuss this with Mic Meow here:

Selections from the UN Anti-Corruption Playbook

Uniting against Corruption: A Playbook on Anti-Corruption Collective Action (2021)

Collective Action is born out of companies’ need to foster more ethical, transparent and less corrupt business environments, while mitigating potential business risks. Collective Action can complement, enhance and further develop current and future laws and regulations whenever the latter are weakly enforced or simply nonexistent. They can even be triggered by CSOs after observing a particularly corruption-risky business sector.

Collective Action is evolving toward a “hybrid co-regulation.” Formal regulation efforts at a global and national level have increasingly been complemented by self-regulation efforts stemming from proactive cooperation between business actors from specific sectors or geographies. This often includes the participation of civil society, the public sector and other organizations.4 These complementary approaches have reinforced one another, creating positive synergies which are required from business in the context of the 2030 Agenda for Sustainable Development.

Businesses and societies face complex corruption challenges on a daily basis around the world, and Collective Action is a key approach to slowing the scale of this issue.

Multi-stakeholder partnerships are indispensable in order to effectively tackle and solve the perennial sustainable development problems outlined in SDG 17.

In the end, the evolution of Collective Action is also the overall evolution from Compliance to Integrity. It is not only about individually avoiding and mitigating the risks, pitfalls and likely costs of corruption such as legal or financial, but above all seizing the opportunities and associated benefits of a robust culture of integrity that is fostered and implemented collectively by a committed group of like-minded stakeholders.

Uniting against Corruption: A Playbook on Anti-Corruption Collective Action (2021)

A few related items:

Cryptocurrency Blockchain and Sharing Economy https://thenextweb.com/news/blockchain-and-the-sharing-economy-a-match-made-in-heaven-this-startup-plans-to-prove-it

Payment systems blockchain economy of value https://m.facebook.com/story.php?story_fbid=pfbid08pQbbjrZgRZ18ZkAuZLzT4E8uAhvSCWbpzbsuykEgH1Yj1p2BtNV9XVWE5sugfs9l&id=100035517380537&mibextid=UyTHkb

https://usa.visa.com/about-visa/visanet.html

https://lex.substack.com/p/podcast-how-banking-and-power-intersect

https://ripple.com/ins…/a-vision-for-the-internet-of-value

Goldbacks private currency https://m.facebook.com/story.php?story_fbid=pfbid0YGcrzjSSgZBh7wP9Ce3yuN2q11sLsASxEFizTRxfqM5y8sWW7do4ZvBCTQF6NqCYl&id=100035517380537&mibextid=UyTHkb

Social Digital Currency https://m.facebook.com/story.php?story_fbid=pfbid0N4V9nDfRTZ3gaD6WkihioBSqN3XE8mB7Q3VYaskp5qXwXJ9DM1B1LdeyqZpDX4dCl&id=100035517380537&mibextid=UyTHkb

Social Digital Currency.

https://medium.com/vdcconsortium/the-social-currency-why-its-time-to-rethink-money-1cd930627b92

https://www.studio-vivace.com/journal/social-currency-creating-value-for-the-world-we-want

See also: https://marketbusinessnews.com/financial-glossary/social-currency-definition-meaning/amp/

Pilot program in Spain.

https://ajuntament.barcelona.cat/digital/en/digital-empowerment/digital-inclusion/rec-barcelonas-social-currency

*Of course, the Federal Reserve is not a public entity, but for the purpose of this post, I link it to government. It is (on paper) subject to some public oversight, which is not the case for Blackrock, which manages the Circle USDC.