Framing the Fourth Industrial Revolution and Inclusive Capitalism Video Series

Overview of the Framework of Inclusive Capitalism – Recorded Live

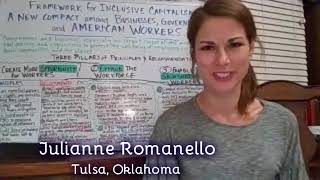

In this video series, I offer a general introduction to the Framework for Inclusive Capitalism, which is the plan for a new global, “sustainable,” economic system that is to be managed by a collaboration between businessess and government. I discuss how ESG investment metrics, human capital scoring, and track and trace technologies contribute to a culture of corporate control, the likes of which the world has not before seen. The Framework is an elaboration of the “Great Reset” plan, introduced in June 2020 by the World Economic Forum during the height of fear and speculation about the worldwide epidemic.

The version of the Framework that I use was written for the USA – its subtitle is “A New Compact Among Businesses, Government, and American Workers” – and it can be downloaded by clicking on the final url listed here. You can find your country’s plan by searching the web for “Inclusive Capitalism” AND the name of your country, or visit the Coalition for Inclusive Capitalism’s homepage for further info.

Special thanks to my friend Bryan Mayberry, who has generously gifted his time and talent to polish up this recording and prepare it for distribution here.

Helpful websites: https://www.coalitionforinclusivecapitalism.com/workers/

http://impinvalliance.org/inclusive-economic-growth https://www.epic-value.com/

Overview of the Framework for Inclusive Capitalism, Part I: PIllar One Principles

Part I: Introduction and Overview of Pillar One – Principles

Part II: Continuing Pillar One – Recommendations

This video is Part II in a series in which I offer a general introduction to the Framework for Inclusive Capitalism, the plan for a new global, “sustainable,” economic system that is to be managed by a collaboration between businessess and government. Part II continues the examination of Pillar One: “Create More Opportunities for Workers [to enter and remain in the workforce],” turning to the specific Recommendations for Businesses and Government that are designed to keep Workers working.

The Recommendations outlined in the Framework are suggestions (in name only – these policies are already being implemented) for Businesses and Government to adopt in order to “Create More Opportunity for Workers” to enter into and remain productive in the Workforce. In the video I try to explain what the buzzwords like Resilience, Sustainability, Employee Wellness, etc. mean for the “American Worker” who will be unhireable if he or she does not embody them 24/7. Labor surpluses (which are forming as a result of growing automation and robotification many jobs) will create a “race-to-the-top” situation in which employment is contingent upon a “worker’s” demonstrated “commitment” to the values and policy program set out in the UN Sustainable Development Goals.

The reason why the SDGs are so important is that they are directly tied to a corporations access to investment capital. The SDGs are the starting point for ESG Investing Metrics – a new set of social / corporate responsibility indicators that are supposed to give mission-oriented, purpose-driven impact investors the information they need to select which companies in which to invest. Impact investors will be looking to invest in corporations that have the highest “S” metrics, which are the measure of how the corporation ranks on Social indices. Here, a company’s Human Capital Assets (the worth of its workforce) are greater if the company’s employees are good 21st century global citizens, They turn into liabilities if a company’s employees aren’t sufficiently socially responsible, as defined by the SDGs and demonstrated by digital record created by the Internet of Things,

Knowing thiat their investors demand the highest degree of social responsibility, the corporations will be careful to hire ONLY those individuals who are top-rated in terms of their do-gooding. But what if you didn’t start volunteering when you were a toddler? Or if you don’t agree with the transgender agenda, or if you forget to recyble that plastic fork one day? Two words:: You’re screwed.

Related video from Facebook: Testing, Resilience, and Job-Sharing: https://www.facebook.com/100035517380537/videos/1344680149301657/